GST Implication on Lease & Sale of Motor vehicle

INTRODUCTION:-

GST law provide two event i.e. Taxable event & Charging

Event, Taxable event in GST is supply of goods or service or both whereas

Charging event in GST is time of supply i.e. At what time GST liability is to

be paid. GST will be payable on every supply of goods or services or both

unless otherwise exempted. In other words GST is applicable only if

transactions constitute the supply, if there is no supply no GST will charged.

Before the discussion we need to know definitions related to this article.

DEFINITION:-

Goods:- As

per the Section 2(52) “goods” means every kind of movable property other than

money and securities but includes actionable claim, growing crops, grass and

things attached to or forming part of the land which are agreed to be severed

before supply or under a contract of supply.

Motor vehicle:-

As per Section 2(28) Motor vehicle Act, 1988, “motor vehicle” or “vehicle”

means any mechanically propelled vehicle adapted for use upon roads whether the

power of propulsion is transmitted thereto from an external or internal source

and includes a chassis to which a body has not been attached and a trailer; but

does not include a vehicle running upon fixed rails or a vehicle of a special

type adapted for use only in a factory or in any other enclosed premises or a

vehicle having less than four wheels fitted with engine capacity of not

exceeding [twenty-five cubic centimeters]

GST on sale of old and used vehicle by an individual (not engaged in any business):-

As we discussed above GST liability raised only in case of

supply of goods or service or both. The term supply has been defined under

Section 7 of the CGST Act,2017 and in order to constitute a supply the sale

should be made by a person in the course of furtherance of business.

In case a used car is sold by any individual (not engaged in

any business), for purchasing a new car, for a consideration, it cannot be said

to be in the course of furtherance of his business, and hence does not qualify

to be a supply. Hence sale of old car does not amount of supply, no GST thereon

will be applicable irrespective of the fact whether such sale is being made to

another unregistered individual or a registered person/car dealer.

GST on sale of old and used vehicle by a GST registered person:-

In cases of registered person sold used car to any person

then without any doubt such a supply will be taxable under GST Law and such a

person needs to pay GST at applicable rates.

Rate of GST on leasing & Sale of Motor Vehicles-Notification No. 37/2017 - Central Tax (Rate)_13.10.2017:-

Notification No. 37/2017 - Central Tax (Rate) Dated 13th

October, 2017 provides the abatement of 35% to the lesser who is into the

business of leasing of motor vehicles. In other words, GST will be levied on

65% of the applicable GST Rate on such Motor Vehicles. The benefit of this notification shall available till 1st July, 2020

subject to fulfilment of below mentioned conditions,

Conditions:-

(I) Condition 1:-

The Motor Vehicles was purchased by lessor prior to 1st July, 2017 and supplied

on lease before 1st July, 2017.

(II) Condition 2:- i) The supplier of Motor Vehicle is a registered person.

ii) Such Supplier had purchased the Motor Vehicle prior to 1st July, 2017 and has not availed input tax credit of Central Excise Duty, Value Added Tax or any other taxes paid on such vehicles.

The above-mentioned Condition No. 1 is relevant to those who are in to the business of leasing of the Motor Vehicles. However, the second condition is applicable to all registered persons. It may be noted that the condition for Non-Availment of input tax credit is applicable to the dealers covered by condition no. 2 and not to the dealer covered by condition no. 1.

It may be noted that the leasing companies who have

purchased the motor vehicle prior to 1st July, 2017 and supplied such vehicles

on lease before 1st July 2017 and availed Input Tax Credit under VAT at the

time of purchase of such vehicle will be liable to pay GST at the rate of 65%

of the applicable GST Rate. Even though Input Tax Credit has been claimed under

VAT on such Vehicles.

Reduction in GST Rate for sale of Old / Used Motor Vehicles-Notification No. 8/2018 - Central Tax (Rate)_25.01.2018:-

Major relief given by the government to the supplier of old

/ used Motor Vehicles through Notification No. 8/2018 - Central Tax (Rate)

dated 25th January 2018. After the Implementation of GST Law, Old / Used Motor

Vehicles were to be taxed at the same percentage of GST as applicable to New

Motor Vehicle i.e. 28% plus Cess as applicable. To make old/used Motor Vehicle

more affordable, on recommendation of GST Council, Government has issued

Notification No. 8/2018 – Central Tax (Rate) dated 25th January 2018. Apart

from that, Government also issued notification to exempt cess on sale of

old/used Motor Vehicles i.e. Notification No. 1/2018-Compensation Cess

(Rate)_25.01.2018.

Applicability:-

The above said notifications are in effect from 25th January 2018. (This

notification shall not apply in case of motor vehicles given on lease.)

Conditions:-

The supplier of such goods has not availed input tax credit as defined in

clause (63) of section 2 of the Central Goods and Services Tax Act, 2017,

CENVAT as defined in CENVAT Credit Rules, 2004 or the input tax credit of Value

Added Tax or any other taxes paid, on such goods.

Valuation:-

If Depreciation

Claimed u/s 32 of Income Tax Act 1961:- In case of a registered person

who has claimed depreciation under section 32 of the Income-Tax Act,1961(43 of

1961) on the said goods, the value that represents the margin of the supplier

shall be the difference between the consideration received for supply of such

goods and the depreciated value of such goods on the date of supply, and where

the margin of such supply is negative, it shall be ignored.

In Other Case:-

In any other case, the value that represents the margin of supplier shall be,

the difference between the selling price and the purchase price and where such

margin is negative, it shall be ignored.

Person Dealing In Buying And Selling Of Second Hand Goods (Rule 32(5) of CGST Rule 2017.):-

Where a

taxable supply is provided by a person dealing in buying and selling of second

hand goods i.e. used goods as such or after such minor processing which does

not change the nature of the goods and where no input tax credit has been

availed on the purchase of such goods, the value of supply shall be the

difference between the selling price and the purchase price and where the value

of such supply is negative, it shall be ignored.

Provided

that the purchase value of goods repossessed from a defaulting borrower, who is

not registered, for the purpose of recovery of a loan or debt shall be deemed

to be the purchase price of such goods by the defaulting borrower reduced by

five percentage points for every quarter or part thereof, between the date of

purchase and the date of disposal by the person making such repossession.

This

rule shall be applicable to those who deal in buying and selling of second hand

goods. Hence, this shall be equally applicable to dealers in the business of

buying and selling of Second Hand Motor Vehicles. Due to it is a special

provision concessional rates of GST on sale of old vehicles would not be

applicable on the outward supplies by such old & used car dealers and

normal rate of GST would be applicable.

Payment of tax under reverse charge on purchase of used vehicle by a registered person from Government:-

As per Notification No. 4/2017-CT (Rate) Dated 28-6-2017

amended vide Notification No. 36/2017-Central Tax (Rate), dated 13-10-2017,

w.e.f. 13-10-2017 in case of used vehicles, supplied by Central Government,

State Government, Union territory or a local authority, the registered person

receiving the supply is liable to pay tax under reverse charge.

In case of sale of used vehicles supplied by Government to

unregistered person, respective department of Central Government, State

Government, Union territory or a local authority should obtain GST registration

and pay GST as per CBIC Circular No. 76/50/2018-GST Dated 31-12-2018.

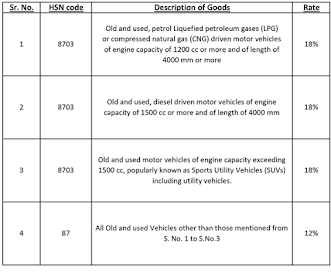

Summary of the GST Rates on sale of Old/Used Motor Vehicles as per Notification No. 8/2018-Central Tax (Rate)_25.01.2018.

GST Implication to “Lessors”:-

GST Implication to “Other than Lessors”:-

Summary on Sale of

Old & Used MV:-

GST Implication in present scenario:-

For Leasing of Motor

Vehicles:-

Taxable Value:- Consideration for the Lease.

Rate of Tax:- GST rate as applicable to new motor

vehicle, on supply of like goods involving transfer of title in goods.

For Sale of Leased Motor Vehicle:-

Taxable Value:- Sales Consideration.

Rate of Tax:- GST rate as applicable to new motor

vehicle.

For New Motor Vehicle Dealer:-

Taxable Value:- Sales Consideration.

Rate of Tax:- GST rate as applicable to new motor

vehicle.

For Old / Used Motor Vehicle Dealer (Second Hand Motor

Vehicle Dealer):-

Taxable Value:- Margin of Supply (Provided ITC not

availed either earlier law or GST Law) OR Sales Consideration (If ITC availed)

Rate of Tax:- GST rate as applicable to new motor

vehicle.

For Old / Used Motor Vehicle sold by registered person

(E.g. Motor car used by registered person for business purpose.):-

Taxable Value:- Margin of Supply (Provided ITC not

availed either earlier law or GST Law) OR Sales Consideration (If ITC availed)

Rate of Tax:- Concessional Rate of GST (Provided ITC

not availed either earlier law or GST Law) OR GST rate as applicable to new

motor vehicle (If ITC availed)

DISCLAIMER:-

This is strictly my personal opinion. Above discussion cannot be considered as our professional or legal advice. Users shall consider legal provisions or take advice from experts before taking action on it.

thanks v.useful info, well explained.

ReplyDeletewell explained ...thank you....

ReplyDeleteI am attracted by the presentation of this article. This information about Motor, is really good. I really appreciate your work. It is a gainful article for us. Keep posting. Thank you.

ReplyDeletePrecision Linear Motors

I found decent information in your post about this. I am fascinated with your work and capacity. Thankful to you. Car Financing In Nigeria

ReplyDeleteExtremely useful information which you have shared here about BMW repair. This is a great way to enhance knowledge for us, and also beneficial for us. Thank you for sharing an article like this.

ReplyDeleteI prefer high-quality content, which I discovered in your article. The information you've provided is useful and important to us. Continue to post articles like these. Thank you very much. CPA Outsourcing Services USA

ReplyDeleteAbsolutely knowledgeable content. Thanks for sharing this kind of content. It is very helpful and very informative and I really learned a lot from it. GST Invoicing Platform For engineering companies

ReplyDeleteThis article provided me with a wealth of information about bulletproof vehicles for sale Miami.The article is incredibly helpful and offers some of the most useful information. Thank you for sharing it with us.

ReplyDeleteI generally want quality content and I found that in your post. The information you have shared about nyc private transportation.....is beneficial and significant for us. Keep sharing these kinds of articles here. Thank you.

ReplyDeleteThe information which you have provided is very good and essential for everyone. Keep sharing this kind of information. Thank you. Emergency Car mechanic

ReplyDeleteA good blog always comes-up with new and exciting information and while reading I have feel that this blog is really have all those quality that qualify a blog to be a one. Read more about sales tax compliance outsourcing India

ReplyDeleteIt was such a good post. Visit Receipt Builder. Thanks for sharing.

ReplyDeleteNice blog!!!

ReplyDeleteIf you are thinking to relocate your household goods from one place to another.

Best shipping company in Dubai