Interest Under the GST

INTRODUCTION:-

The Government of India has specified the due dates to pay Goods and

Services Tax. The due date to pay GST is different for different types of

taxpayers. If one fails to pay GST within the due date, one must pay the

interest along with the GST dues for the delay period.

RELEVANT SECTION & RULE:-

Section:- Section 50 of CGST

Act, 2017

Rule:- Rule 88B of CGST

Rule, 2017.

CIRCUMSTANCES WHEN

INTEREST TO BE PAID:-

1)

Interest related to GST on sales. (Section 50(1))

·

Fails to pay such GST within the period as prescribed

by GST Act, 2017 and Rules.

·

Makes short payment for the GST.

2)

Interest related to ITC. (Section 50(3))

·

Wrong ITC availed AND Utilized.

·

ITC availed AND Utilized

over what they are eligible.

RATE OF INTEREST:-

1)

Interest related to GST on sales. :- 18% p.a.

2)

Interest related to ITC.:- 24% p.a.

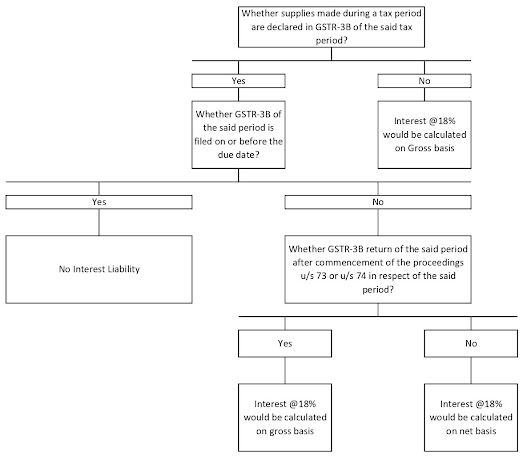

INTEREST LEVY UNDER GST:-

1)

ABC Ltd. Has to pay GST on outward supply is Rs. 40

Lakhs and have ITC of Rs. 20 Lakhs in January 2023 and the due date for January

Return is 20th of Feb 23. But ABC Ltd. Have file the January return

on 28th of Feb 23.

What is the Interest

Amount?

Ans.:-

GST on Sales Rs. 40 Lakhs.

ITC of Rs. 20 Lakhs.

Net Cash Liability of Rs. 20 Lakhs.

Interest Rate is 18%.

Interest :- {20 Lakhs*18%*8/365} = Rs. 7,890/-

2)

ABC Ltd. Has to pay GST on outward supply is Rs. 40

Lakhs and have ITC of Rs. 60 Lakhs in January 2023 and the due date for January

Return is 20th of Feb 23. But ABC Ltd. Have file the January return

on 28th of Feb 23.

What is the Interest

Amount?

Ans.:-

GST on Sales Rs. 40 Lakhs.

ITC of Rs. 60 Lakhs.

Net Cash Liability of Rs. NIL

Interest Rate is 18%.

Interest :- NIL.

IMPORTANT POINTS RELATED TO ITC AVAILED AND UTILISED:-

1)

Input tax credit wrongly availed shall be construed to

have been utilized, when the balance in the electronic credit ledger falls below

the amount of input tax credit wrongly availed, and the extent of such

utilization of input tax credit shall be the amount by which the balance in the

electronic credit ledger falls below the amount of input tax credit wrongly

availed.

2)

The date of utilization of such input tax credit shall

be taken to be,

·

The date, on which the return is due to be furnished

under section 39 or the actual date of filing of the said return, whichever is earlier,

if the balance in the electronic credit ledger falls below the amount of input

tax credit wrongly availed, on account of payment of tax through the said

return.

·

The date of debit in the electronic credit ledger when

the balance in the electronic credit ledger falls below the amount of input tax

credit wrongly availed, in all other cases.

Comments

Post a Comment