GST Refund on Export of Goods (Updated as on 13.11.2023)

INTRODUCTION: -

The aim of Indian government is to increasing

the output and quality of export from India in pursuance to the “Make in India”

policy. Indian government also provide the many incentives to the exporters to

boost export in India and in addition to incentives, government also provide

many benefits as far GST is concerned. Like Refund of GST in export of goods or

Service.

CATEGORY OF EXPORT: -

1. Export of

goods.

·

Direct Export.

·

Deemed Export. (Will discuss in

different article).

·

Export throughout Customer. (Will

discuss in different article).

·

Export to Nepal & Bhutan. (Will

discuss in different article)

2. Export of

Service.

First, we

will look definitions: -

Goods: -

As per the section 2(52) of CGST Act, 2017

"Goods" means every kind of movable property other than money and

securities but includes actionable claim, growing crops, grass and things

attached to or forming part of the land which are agreed to be severed before

supply or under a contract of supply.

Export of Goods: -

As per the Section 2(5) of IGST Act, 2017 “Export of

goods” with its grammatical variations and cognate expressions, means taking

goods out of India to a place outside India.

From the above definition it can be seen that to

qualify supply as an export then goods must be taken out of India.

ZERO RATED SUPPLY (U/s 16 of IGST Act, 2017): -

1)

“Zero rated supply” means any of the

following supplies of goods or services or both, namely

(a)

Export of goods or services or both or

(b)

Supply of goods or services or both for

authorised operation (Inserted wide Finance Bill 2021) to a Special

Economic Zone developer or a Special Economic Zone unit.

In

Addition to this Section 147 of CGST Act, 2017 considered certain supplies as

Deemed Export, which means Deemed export also eligible for zero rated supply.

2)

Credit of input tax may be availed for

making zero-rated supplies, notwithstanding that such supply may be an exempt

supply subject to Section 17(5) of CGST Act, 2017 i.e., Negative List.

3)

A registered person making zero rated supply

shall be eligible to claim refund of unutilized input tax credit on supply of

goods or services or both, without payment of integrated tax, under bond or

Letter of Undertaking, in accordance with the provisions of section 54 of the

Central Goods and Services Tax Act or the rules made thereunder, subject to

such conditions, safeguards and procedure as may be prescribed.

Provided that the registered person making

zero rated supply of goods shall, in case of non-realization of sale proceeds,

be liable to deposit the refund so received , to the extent of non-realization

of sales proceeds, under this sub-section along with the applicable interest

under section 50 of the Central Goods and Services Tax Act within thirty days

after the expiry of the time limit prescribed under the Foreign Exchange

Management Act, 1999 for receipt of foreign exchange remittances, in such

manner as may be prescribed. (Whole Paragraph was substitute by finance Act,

2021) (Read with rule 96B of CGST Act, 2017).

Period of realization of foreign exchange as

per FEMA 1999 is as per RBI Guidelines and as per RBI foreign exchange should

be received within NINE Months from the date of Export.

4)

The Government may, on the recommendation of

the Council, and subject to such conditions, safeguards and procedures, by

notification, specify.

a)

Class of persons who may make zero rated

supply on payment of integrated tax and claim refund of the tax so paid.

b)

A class of goods or services which may be

exported on payment of integrated tax and the supplier of such goods or

services may claim the refund of tax so paid.

(Inserted

wide Finance bill 2021)

Zero-rated

supply does not mean that the goods and services have a tariff rate of ‘0%’ but

the recipient to whom the supply is made is entitled to pay ‘0%’ GST to the

supplier.

TREATMENT OF EXPORT UNDER GST LAW: -

As per the

Section 7(5) of IGST Act, 2017 Export is treated as Inter-State Supply and IGST

charge on Export.

REFUND

FOR ZERO RATED SUPPLY: -

An

Exporter dealing in Zero Rated supply under GST can claim a refund as per

following Options.

1)

Export without payment of IGST under

Bond/LUT and Claim Refund of ITC.

2)

Export with payment of IGST and Claim

Refund of IGST Paid.

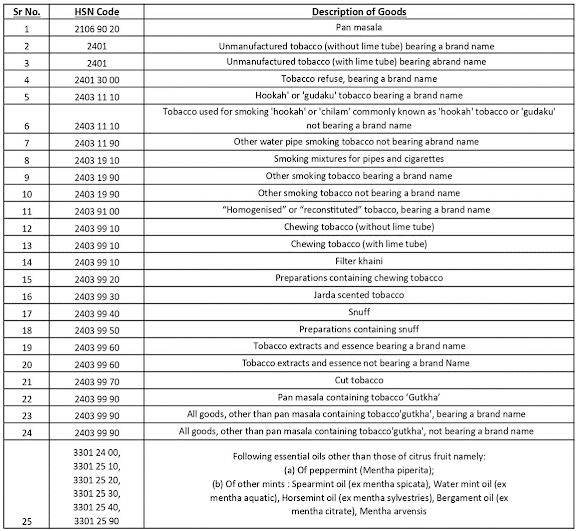

However,

following specified goods cannot be exported with payment of IGST and hence

such goods can be exported compulsorily without payment of IGST under Bond or

LUT. (As per Notification No. 01/2023 – Integrated Tax_31.07.2023) (Applicable

from 01.10.2023).

WHAT IS LETTER OF UNDERTAKING & BOND UNDER GST: -

If Exporter choose option one for export, He

needs to file the Bond/LUT with the tax department stating that he shall

fulfill all the export requirements.

WHEN

BOND IS TO BE FILED UNDER GST: -

Any Registered person who has been prosecuted

for any offence under the Central Goods and Services Tax Act, 2017 (12 of 2017)

or the Integrated Goods and Services Tax Act, 2017 (13 of 2017) or any of the

existing laws in force in a case where the amount of tax evaded exceeds two hundred

and fifty lakh rupees (>250 Lakhs). (Notification No. 37/2017-Central Tax

Dt. 04th Oct, 2017) (This Notification suspend the notification No. 16/2017-Central Tax, Dt. 7th

July, 2017).

WHEN

LUT IS TO BE FILED UNDER GST: -

All registered persons who intend to supply

goods or services for export without payment of integrated tax shall be

eligible to furnish a Letter of Undertaking in place of a bond except those who

have been prosecuted for any offence under the Central Goods and Services Tax

Act, 2017 (12 of 2017) or the Integrated Goods and Services Tax Act, 2017 (13

of 2017) or any of the existing laws in force in a case where the amount of tax

evaded exceeds two hundred and fifty lakh rupees (>250 Lakhs). (Notification

No. 37/2017-Central Tax Dt. 04th Oct, 2017) (This Notification

suspend the notification No.

16/2017-Central Tax, Dt. 7th July, 2017).

Conditions of

LUT: -

·

Goods shall

be exported within three months (3 Months) from the date of issue of the

invoice for export. (Rule 96A(1) of CGST

Act, 2017).

Registered

person making zero rated supply of goods shall, in case of non-realization of

sale proceeds, be liable to deposit the refund so received , to the extent of

non-realization of sales proceeds, under this sub-section along with the

applicable interest under section 50 of the Central Goods and Services Tax Act

within thirty days after the expiry of the time limit prescribed under the

Foreign Exchange Management Act, 1999 for receipt of foreign exchange

remittances, in such manner as may be prescribed. (Whole Paragraph was

substitute by finance Act, 2021) (Read with rule 96B of CGST Act, 2017).

Period

of realization of foreign exchange as per FEMA 1999 is as per RBI Guidelines

and as per RBI foreign exchange should be received within NINE Months

from the date of Export.

·

Foreign

payment should be received within one year (1 Year) from the date of issue of

the invoice for export. (Rule 96A(1) of CGST Act, 2017).

Validity of LUT: - The LUT shall be valid for the whole financial year in which it is tendered. However, in case the goods are not exported within the time specified in sub rule (1) of rule 96A of the CGST Rules and the registered person fails to pay the amount Mentioned in the said sub-rule, the facility of export under LUT will be deemed to have been withdrawn. If the amount mentioned in the said sub-rule is paid subsequently, the facility of export under LUT shall be restored. As a result, exports, during the period from when the facility to export under LUT is withdrawn till the time the same is restored, shall be either on payment of the applicable integrated tax or under bond with bank guarantee. (Circular No. 8/8/2017-GST Dt. 4th Oct, 2017).

Documents for LUT:- Self-declaration to the effect that the conditions of LUT have been fulfilled shall be accepted unless there is specific information otherwise. That is, self-declaration by the exporter to the effect that he has not been prosecuted should suffice for the purposes of Notification No. 37/2017- Central Tax dated 4th October, 2017. (Circular No. 8/8/2017-GST Dt. 4th Oct, 2017).

FORM OF BOND/LUT:-

FORM GST RFD-11

WHO

WILL EXECUTE BOND/LUT:-

The proprietor.

Working partner or by a person duly authorised

by such working partner.

The Managing Director or Board of Directors of

such company.

The Company Secretary.

TIME FOR ACCEPTANCE OF LUT/BOND:-

As LUT/Bond is a priori requirement for

export, including exports to a SEZ developer or a SEZ unit, the LUT/bond should

be processed on top most priority. It is clarified that LUT/bond should be

accepted within a period of three working days of its receipt along with the

self-declaration as stated in above by the exporter. If the LUT / bond is not

accepted within a period of three working days from the date of submission, it

shall deemed to be accepted. (Circular

No. 8/8/2017-GST Dt. 4th Oct, 2017).

EXPORT

OF GOODS OR SERVICE UNDER BOND OR LUT RULE 96A (OPTION 1):-

Any registered person availing the option to

supply goods or services for export without payment of integrated tax shall

furnish, prior to export, a bond or a Letter of Undertaking in FORM GST RFD-11

to the jurisdictional Commissioner, binding himself to pay the tax due along

with the interest specified under sub-section (1) of section 50 within a period

of,

1) Fifteen

days after the expiry of three months or such further period as may be allowed

by the Commissioner from the date of issue of the invoice for export, if the

goods are not exported out of India. (I.e. Goods should be exported within

three months from the date of Export Invoice.)

2) Fifteen

days after the expiry of one year, or such further period as may be allowed by

the Commissioner, from the date of issue of the invoice for export, if the

payment of such services is not received by the exporter in convertible foreign

exchange [or in Indian rupees, wherever permitted by the Reserve Bank of

India].

Where the goods are not exported within the time specified in above rule and the registered person fails to pay the amount mentioned in the said sub-rule, the export as allowed under bond or Letter of Undertaking shall be withdrawn forthwith and the said amount shall be recovered from the registered person in accordance with the provisions of section 79 (Recovery of Tax).

The export as allowed under bond or Letter of Undertaking withdrawn in terms of above rule shall be restored immediately when the registered person pays the amount due.

Rule 96A also applied in respect of zero-rated supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit without payment of integrated tax.

Registered person making zero rated supply of goods shall, in case of non-realization of sale proceeds, be liable to deposit the refund so received , to the extent of non-realization of sales proceeds, under this sub-section along with the applicable interest under section 50 of the Central Goods and Services Tax Act within thirty days after the expiry of the time limit prescribed under the Foreign Exchange Management Act, 1999 for receipt of foreign exchange remittances, in such manner as may be prescribed. (Whole Paragraph was substitute by finance Act, 2021) (Read with rule 96B of CGST Act, 2017).

Period of realization of foreign exchange as per FEMA 1999 is as per RBI Guidelines and as per RBI foreign exchange should be received within NINE Months from the date of Export.

Formula: -

Section

16(3) of the IGST Act gives the option to an exporter to claim refund either as

ITC by making export without payment of tax through LUT, as below

The formula is reproduced

below Rule 89(4): -

(A)

"Refund amount" means the maximum refund that is admissible.

Zero-rated supply of

services is the aggregate of the payments received during the relevant period

for zero-rated supply of services and zero-rated supply of services where

supply has been completed for which payment had been received in advance in any

period prior to the relevant period reduced by advances received for zero-rated

supply of services for which the supply of services has not been completed

during the relevant period.

Substituted (W.E.F 23.10.2017) by Notification No. 75/2017 – Central Tax_29.12.2017.

Where,

(A)

"Refund amount" means the maximum refund that is admissible.

Zero-rated supply of

services is the aggregate of the payments received during the relevant period

for zero-rated supply of services and zero-rated supply of services where

supply has been completed for which payment had been received in advance in any

period prior to the relevant period reduced by advances received for zero-rated

supply of services for which the supply of services has not been completed

during the relevant period.

(a) the value of exempt supplies other than

zero-rated supplies and

(b) the turnover of

supplies in respect of which refund is claimed under sub-rules (4A) or (4B) or

both, if any, during the relevant period.

Further Substituted by Notification No. 16/2020 – Central Tax_23.03.2020.

In rule 89, in sub-rule (4), for clause (C), the following clause shall be substituted, namely: -

Illustration of amended definition of Turnover of zero-rated supply of goods.

Suppose a supplier is manufacturing only one type of goods and is supplying the same goods in both domestic market and overseas. During the relevant period of refund, the details of his inward supply and outward supply details are shown in the table below:

|

Outward Supply |

Value per unit |

No of units supplied |

Turnover |

Turnover as per amended definition |

|

Local

(Quantity 5) |

200.00 |

5.00 |

1,000.00 |

1,000.00 |

|

Export

(Quantity 5) |

350.00 |

5.00 |

1,750.00 |

1500 (1.5*5*200) |

|

Total |

|

|

2,750.00 |

2,500.00 |

The formula for calculation of refund as per Rule 89(4) is:

Refund Amount = (Turnover of zero-rated supply of goods + Turnover of zero-rated

supply of services) x Net ITC ÷Adjusted Total Turnover

ISSUE ALL ABOUT:-

There are

discrepancies between the Invoice Value and value in the shipping bill/bill of

export and hence required clarity on which one should be adopted as export

value for the purpose of refund. This has been clarified in circular no.

37/11/2018-GST dated 15/Mar/2018. and further reiterated in the Master Circular

125/44/2019 dated 18/Nov/2019 that the lower of the two is to be considered in

the numerator for calculating the refund. Para 9 of circular no. 37/11/2018-GST

dated 15/Mar/2018 is reproduced below: -

Discrepancy between values of GST invoice and shipping bill/bill

of export: It has been brought to the notice of the Board that in certain cases,

where the refund of unutilized input tax credit on account of export of goods

is claimed and the value declared in the tax invoice is different from the

export value declared in the corresponding shipping bill under the Customs Act,

refund claims are not being processed. The matter has been examined and

it is clarified that the zero-rated supply of goods is effected under the

provisions of the GST laws. An exporter, at the time of supply of goods

declares that the goods are for export and the same is done under an invoice

issued under rule 46 of the CGST Rules. The value recorded in the GST invoice

should normally be the transaction value as determined under Page 5 of 8 section

15 of the CGST Act read with the rules made thereunder. The same transaction

value should normally be recorded in the corresponding shipping bill / bill of

export.

Whereas this clarification has created further ambiguity amongst

the taxpayers and the tax officers on two matters: -

Explanation.: - For the purposes of this sub-rule, the

value of goods exported out of India shall be taken as

(i)

The Free on Board (FOB) value declared in the Shipping Bill or Bill of

Export form, as the case may be, as per the Shipping Bill and Bill of Export

(Forms) Regulations, 2017. OR

(ii) The value declared in tax invoice or bill of

supply.

whichever is less.

However, the

second question on which value to be considered as export value for the purpose

of the calculation of Adjusted Total Turnover – whether the value determined in

the numerator as ‘Turnover of Zero-rated supply of goods or the value as

declared in the returns filed for the relevant period – remained unanswered.

Examples: -

EXPORT OF GOODS WITH PAYMENT OF IGST RULE 96 (OPTION 2):-

The shipping bill filed by an exporter of

goods shall be deemed to be an application for refund of integrated tax paid on

the goods exported out of India and such application shall be deemed to have

been filed only when,

1) The

person in charge of the conveyance carrying the export goods duly files a

departure manifest or an export manifest or an export report covering the

number and the date of shipping bills or bills of export.

2) The applicant has furnished a valid return in FORM GSTR-3B.

3) The

details of the relevant export invoices in respect of export of goods contained

in FORM GSTR-1 shall be transmitted electronically by the common portal

to the system designated by the Customs and the said system shall

electronically transmit to the common portal, a confirmation that the goods

covered by the said invoices have been exported out of India.

Comments

Post a Comment